Most Commented

ezPaycheck 3.14.3

Description material

File size: 18.5 MB

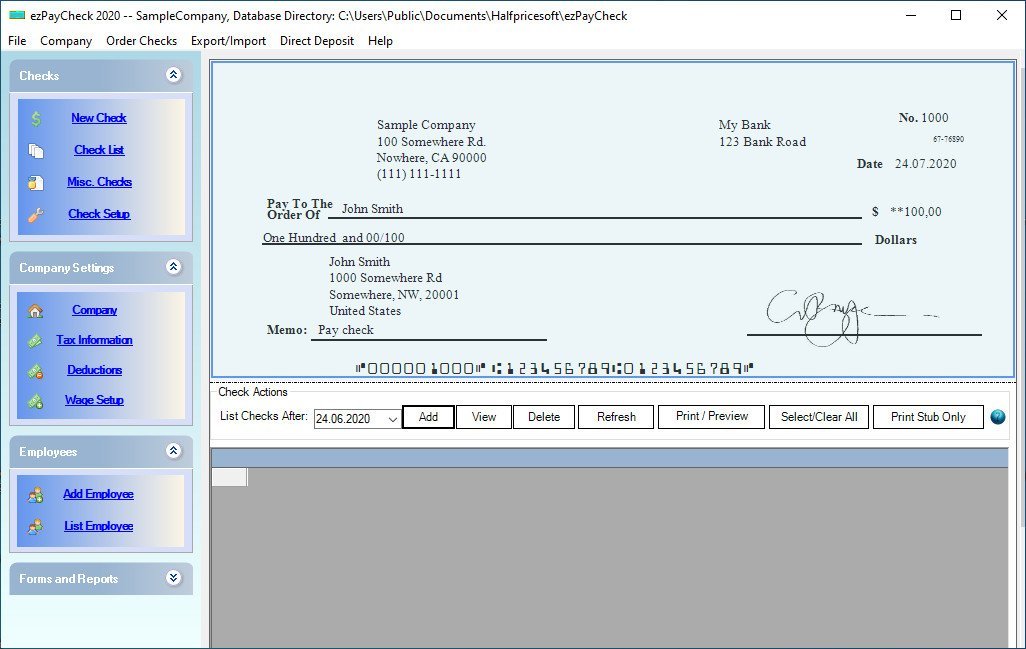

ezPaycheck is an easy-to-use payroll software designed with small businesses in mind: simple, reliable and affordable. Our developers designed it to be a in house payroll tax solution for small businesses to calculate taxes, print paychecks for employees & contractors, generate reports and print tax forms.

Features

Calculates federal & state payroll taxes/deductions and the local taxes (such as SDI, occupational tax, city tax)

Prints paychecks and tax forms

Supports salary, hourly-rate, commission, tips and customized wages (such as pay-by-piece, pay-by-stop and pay-by-mileage)

Flexible tax options for W2/1099 employees and unique needs of churches & non-profits employees

Screen :

What's New

HOMEPAGE

https://www.halfpricesoft.com/

Buy Premium Account From My Download Links & Get Fastest Speed.

Tags: ezPaycheck

Join to our telegram Group

Information

Users of Guests are not allowed to comment this publication.

Users of Guests are not allowed to comment this publication.

Choose Site Language

Recommended news

Commented

![eM Client Pro 9.2.1735 Multilingual [Updated]](https://pikky.net/medium/wXgc.png)

![Movavi Video Editor 24.0.2.0 Multilingual [ Updated]](https://pikky.net/medium/qhrc.png)