Most Commented

Operational Risk in Banking and Financial Services

Description material

Published 7/2024 MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz, 2 Ch Language: English | Duration: 2h 17m | Size: 1.31 GB

Learn the fundamental concepts required to manage operational risk in banks and financial institutions

What you'll learn

Understand concept and types of Operational Risk

Understand the fundamentals of operational risk management

Learn key steps involved in Operational Risk Management

Understand data requirements for operational risk mamagement

External Data Sources and Operational Risk

Capital Requirement for Operational Risk

BASEL-III Capital Requirement Calculation

Emerging Trends in Operational Risk

Requirements

There are no requirements in terms of educational or professional background for this course. However, it is recommneded that people joining this course should have basic understanding of how an orgnaistaion works.

Description

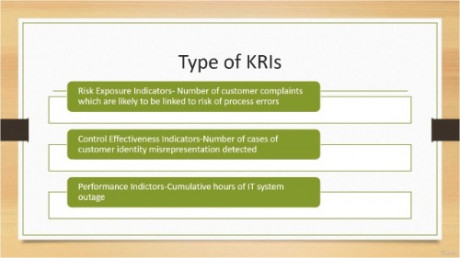

Banks and financial institutions are exposed to various types of risks. Operational risk is one of those risks. Operational risk is different from other risks in many ways and hence needs to be studied in detail. When a bank takes credit risk, it may potentially get rewarded with higher return but it is not the case with operational risk. Operational risk have no risk versus reward linkages. Management of these risks help in avoidance of potential losses.Operational risks have the potential to derail business operations and even result in closure/failure of an organisation. There are many examples across the world which demonstrate how banks and financial institutions suffered millions of dollars of losses because of operational risk. Banks and financial institutions often find it challenging to manage operational risks as they are abstract in nature and difficult to quantify. Because of these factors, it is important to understand operational risk management in a structured way.This course on operational risk in banking and financial services has been designed with an objective to help students/aspirants/participants learn following key aspects of operational risk:Understanding various types of risks and their linkages with operational riskMeaning of operational riskTypes of operational riskCategories of operational riskUnderstanding operational risk management processSignificance of data in operational risk managementTools and methods to manage operational riskIssues in managing operational riskEmerging trends in operational riskThere are case studies and industry relevant examples which will help participants relate to real life instance of operational risk. Quiz is also part of this course which help participants assess their understanding of operational risk.

Who this course is for

Executives working in risk management domain

Compliance risk professionals

Students wanting to make career in operational risk management

Risk champions working in banks and financial institutions

Employees working in banks and financial institutions wanting to make career in operational risk management

Download

RapidGator

FileStore

NitroFlare

RapidGator

FileStore

NitroFlare

Join to our telegram Group

Information

Users of Guests are not allowed to comment this publication.

Users of Guests are not allowed to comment this publication.

Choose Site Language

Recommended news

Commented

![eM Client Pro 9.2.1735 Multilingual [Updated]](https://pikky.net/medium/wXgc.png)

![[PORTABLE] Gillmeister Automatic PDF Processor 1.20.1](https://i.postimg.cc/638TyGnw/Gillmeister-Automatic-PDF-Processor.png)

![Movavi Video Editor 24.0.2.0 Multilingual [ Updated]](https://pikky.net/medium/qhrc.png)