Most Commented

Udemy TallyPrime GST Payroll IncomeTax TDS TCS MSExcel ComboPack

Description material

54.12 GB | 02:26:06 | mp4 | 1920X1080 | 16:9

Genre:eLearning |Language:English

Files Included :

1 - S11 What is Commerce (48.48 MB)

2 - S12 What is Accounting Why do we need it (22.49 MB)

3 - S13 Double Entry Accounting System Steps Structure (268.6 MB)

4 - S14 Golden Rules of Accounts (26.69 MB)

5 - S15 Rules of Accounts with Journals (43.44 MB)

6 - S16 Fundamentals of Accounting (127.52 MB)

100 - S105 Prepaid and Outstanding related adjustments (81.81 MB)

101 - S106 TallyPrime Closing Backup Split Company Setup New FY (122.59 MB)

96 - S101 Golden Rules of Accounts Treatment Statements (17.8 MB)

97 - S102 Capital and Drawings Related Adjustments (372.58 MB)

98 - S103 Party Related Adjustments Settlement Discounts Bad debts Reserves (362.15 MB)

99 - S104 Appreciation and Depreciation related adjustments (359.4 MB)

102 - S111 Tally Test Paper1 Comprehensive Case Study Recap (1.65 GB)

103 - S121 What is Payroll I An Introduction (22.5 MB)

104 - S122 What is Basic Salary methods of calculating basic salary (80.83 MB)

105 - S123 What is DA methods of Calculating DA (97.34 MB)

106 - S124 What is HRA how to Calculate HRA Taxability and Exemption Calculation (46.97 MB)

107 - S125 Payheads CA TA LTA I Conveyance Allowance I Travel Allowance I Leave TA (32.71 MB)

108 - S126 EPF I Employee Provident Fund I Calculation I Employee and Employer Contri (153.28 MB)

109 - S127 ESI I Employee State Insurance I Rules I Percentages I Contribution Period (419.5 MB)

110 - S128 What is Gratuity I Calculation of Gratuity I Taxability I Ceiling Limit (35.5 MB)

111 - S129 Bonus Act 1965 I What is Bonus How to Calculate Taxability (380.4 MB)

112 - S1210 Income Tax on Salary I TDS Computation Cess Surcharges Salary Incremen (1.1 GB)

113 - S1211 Professional Tax Statwise I Applicability I Slabs (40.72 MB)

114 - S1212 CTC vs Gross Salary vs Net Salary (51.84 MB)

115 - S1213 Attendance Sheer Preparation I Present Paid Leaves Absents Holidays us (284.56 MB)

116 - S1214 Complete Payroll Processing I Basic DA HRA CA TA LTA Bonus PF ESI (674.33 MB)

117 - S1215 PaySlip Generation from Paysheet in MS Excel (716.87 MB)

118 - S1216 TDS Deposit on Income Tax Portal (291.04 MB)

119 - S1217 Employer Contributions PF ESI (404.59 MB)

120 - S1218 EPFESI Establishment Registration (836.41 MB)

121 - S1219 Add Exit of Employee Records on EPFO website (141.6 MB)

122 - S1220 EPF Returns Preparation Filing (530.91 MB)

123 - S1221 EPF Nil Return Filing (15.4 MB)

124 - S1222 How to Add Employee in ESI website I generate IP Number (136.04 MB)

125 - S1223 ESI Returns Preparation and Filing (123.97 MB)

126 - S1224 Comprehensive Case Study TDS ON SALARY P1 Payroll and TDS Deposits (1.2 GB)

127 - S1225 Comprehensive Case Study TDS ON SALARY P2 TDS Returns Filing 24Q (1.46 GB)

128 - S131 What is GSTa short Introduction to GST (77.92 MB)

129 - S132 GST Classifications and Place of Supply (17.76 MB)

130 - S133 Understand GST Number (17.93 MB)

131 - S134 GST Registration Threshold Limits and Documents Required for GST Registrat (35.83 MB)

132 - S135 GST RegistrationProprietorship and Partnership (1.11 GB)

133 - S136 Track Submitted Application Status (11.33 MB)

134 - S137 GST Registration Filing Clarifications (29.57 MB)

135 - S138 GST Practitioner Registration (108.6 MB)

136 - S139 How to Download GST Certificate (17.47 MB)

137 - S1310 GST Amendments Core Fields and Non Core Fields (262.25 MB)

138 - S1311 GST Opting Regular or Composition (135.39 MB)

139 - S1312 GST Cancellation and Revocation (146.88 MB)

140 - S1313 What is GST Returns Types of GST Returns (153.41 MB)

141 - S1314 Learn GSTR1 Tables (270.94 MB)

142 - S1315 GSTR1 Filing using TallyPrime (246.5 MB)

143 - S1316 Filing NilGSTR1 I when there is no Sales (32.85 MB)

144 - S1317 GSTR1 Amendments I Modify Previous Months Invoices (64.99 MB)

145 - S1318 Purchases Reconciliation I GSTR2A Reconciliation I 2 Methods (556.33 MB)

146 - S1319 GSTR3B Tax Payment I Filing GSTR3B I Tax Summary Adjustments (215.28 MB)

147 - S1320 GST Composition scheme introduction Slabs Eligibility (70.28 MB)

148 - S1321 GST CMP08 Filing Composition GST Return Filing (151.21 MB)

149 - S1322 GST Refund Compete Process (384.05 MB)

150 - S1323 How to Generate Eway bill Registration Print Cancellation Masters Cr (373.79 MB)

151 - S1324 E Invoice Introduction (12.44 MB)

152 - S1325 EInvoice GSTIN Registration of E Invoice Portal (21.86 MB)

153 - S1326 EInvoice Enablement for GSTIN on E Invoice Portal (53.45 MB)

154 - S1327 EInvoice API User Creation for Your Accounting Software (77.95 MB)

155 - S1328 Generate EInvoice using Tally Generate and EInvoice Print within Tal (163.7 MB)

156 - S1329 E Invoice Cancellation in Tally as well as Einvoice Portal (84.55 MB)

157 - S1330 EInvoice Generation Tally to JSON JSON Manual Upload on E Invoice Po (86.19 MB)

158 - S1331 EInvoice Generation Using Official Excel kit Excel to JSON JSON uploa (58.68 MB)

159 - 1 TallyERP9 with GST and Excel Combo Pack Intro Video (52.14 MB)

160 - 2 TallyERP9 Download New Portal (7.83 MB)

161 - 3 Tally Introduction History Advantages (119.48 MB)

162 - 4 Costing of Tally (2.22 MB)

163 - 5 TallyERP9 Downloading Installation Activation (40.8 MB)

164 - 6 Golden Rules of Accounts (46.78 MB)

165 - 7 TallyERP9 with GST Course Material (210.2 KB)

166 - 8 Company Creation Alteration Deletion Securing (619.46 MB)

167 - 9 Understanding Tally Pre defined Vouchers (46.92 MB)

168 - 10 Tally Data Processing Structure (212.45 MB)

169 - 11 Understanding Tally with Basic Illustrations (93.17 MB)

170 - 12 Recording Maintaining Installments in TallyERP9 I Billwise accounts (262.64 MB)

171 - 13 Recording Maintaining Supply against Advances Advances Management (165.87 MB)

172 - 14 Tracking OverDue Supply Credit Sales (171.26 MB)

173 - 15 Multi Currency Accounting in TallyERP9 Adjustment Entries of Forex Gain (185.62 MB)

174 - 16 Cheque Book Configuration in TallyERP9 (108.7 MB)

175 - 17 Banking Transaction Types ATM Credit Debit Cards Online Banking more (60.72 MB)

176 - 18 Post Dated Cheques Management in TallyERP9 I PDCs (292.35 MB)

177 - 19 BankReconciliationIntroductionTheory (37.81 MB)

178 - 20 BankReconciliationinTallyERP9IPracticalCaseStudy1 (1.37 GB)

179 - 21 Bank Reconciliation in TallyERP9 I CaseStudy2 (874.2 MB)

180 - 24 Enabling GST Features in TallyERP9 (76.18 MB)

181 - 25 Recording GST Transactions in TallyERP9 I SMART method (205.01 MB)

182 - 26RecordingGSTTransaction TraditionalMethod (110.09 MB)

183 - 27 Recording GST Transactions CaseStudy2 (286.35 MB)

184 - 28 GST Tax Invoice Configuration Voucher Numbering (40.71 MB)

185 - 29 Recording GST Transaction with Auto Billing (84.51 MB)

186 - 30 GST Tax Invoice Bank Details Customer Seal Signature Jurisdiction Print (326.76 MB)

187 - 31 Rate Inclusive of Tax Item Description in TallyERP9 (51.66 MB)

188 - 32 Recording GST Transactions Services (50.6 MB)

189 - 33 Recording GST Transactions Assets I with Input Tax Credit I without ITC (52.8 MB)

190 - 34 Recording GST Transactions Expenses with without Input Tax Credit (48.18 MB)

191 - 35 Recording GST Transactions Sales with Additional Expenditure (27.7 MB)

192 - 37 GST Recording RCM in TallyERP9 (179.31 MB)

193 - 55 Recording TDS Transaction in TallyERP9 (82.93 MB)

194 - 54 How to Configure TDS in TallyERP9 Recordinng TDS Entries in Tally (105.72 MB)

195 - 56 Purchase Returns Sales Returns in TallyERP9 (93.06 MB)

196 - 53 What is TDS Tax deduction at source How to calculate TDS Introductio (39.38 MB)

197 - 57 Delivery Notes Receipt Notes in TallyERP9 (113.59 MB)

198 - 58 Sales OrdersQuotations in TallyERP9 (54.98 MB)

199 - 59 TallyERP9 Discounts I TradeDiscounts Cash Discounts (108.63 MB)

200 - 60 PriceLists in TallyERP9 I Party Level Product Level (47.06 MB)

201 - 61 AutoInterest Calculation on Overdue Installments (611.38 MB)

202 - 62 Basic of Manufacturing (84.39 MB)

203 - 63 Standard Manufacturing Practicals in TallyERP9 (806.31 MB)

204 - 64 Cost Centres in TallyERP9 Departments Handling (150.05 MB)

205 - 65 BranchWise AccountsUsing Cost Centers Godowns in TallyERP9 (928.37 MB)

206 - 66 Multi User Creation in TallyERP9 (45.26 MB)

207 - 67 Security Password for Users in TallyERP9 (32 MB)

208 - 68 Tally Internal Data Verification Tally Audit (26.1 MB)

209 - 69 Recording Year End Adjustments in TallyERP9 (321.61 MB)

210 - 70 Capital Adjustments I Drawings Adjustments Closing I Profit Sharing I Spli (250.14 MB)

211 - 71 Payroll in TallyERP9 Introduction to Steps (17.5 MB)

212 - 72 PayrollComplete Setup Monthly Process Stop Computation Overall Coverag (473.98 MB)

213 - 73 Budgets in TallyERP9 (48.11 MB)

214 - 74 Calculator Usage in TallyERP9 (12.13 MB)

215 - 75 Tally Data Backup Restore (93.6 MB)

216 - 76 Alternate Units of Measurement in TallyERP9 (24.38 MB)

217 - 77 Batches Management with Date of Manufacturing Expiry (92.06 MB)

218 - 78 Data Searching in TallyERP9 (96.06 MB)

219 - 79 Day Book Features in TallyERP9 (156.84 MB)

220 - 80 POS in TallyERP9 (53.13 MB)

221 - 81 Splitting in TallyERP9 (43.05 MB)

222 - 82 Part Numbers in TallyERP9 (17.55 MB)

223 - 83 Standard Rate Setup in TallyERP9 (18.39 MB)

224 - 84 Zero Valued Transaction (14.08 MB)

225 - 85 Exports I Tally to JPEG PDF HTML XML (82.1 MB)

226 - 86 Data Export Import in TallyERP9 (63.09 MB)

227 - 87 Live Mailing from TallyERP9 (160.93 MB)

228 - 88 Tax Audit Due Dates Extended (2.57 MB)

229 - 89 Logo Printing in TallyERP9 (49.64 MB)

230 - 90 Reply to Students Request Refund Applied I Deducted on GSTN INot Credited2 b (167.41 MB)

231 - 92 Budget2020IHighlightsIOldNewSlabs (33.55 MB)

232 - 93 37th GST Council meeting I 2 Major decisions I Relaxation of filing GSTR9 (11.89 MB)

233 - 94 Highlightsof38thGSTCouncilMeeting (56.31 MB)

234 - 96 Item Description in TallyERP9 without instructor (26.83 MB)

235 - 97 JobOrderProcessinginTallyApplication (304.7 MB)

236 - 98 Tally Certifications Student Dashboard Job Portal Benefits (7.57 MB)

237 - 99 Tally Certification Types How to Apply for it (11.88 MB)

238 - 100 Interview Tips (7.65 MB)

239 - ITR1 Filing Advance Tax Payment Comprehensive Case Study (1.4 GB)

240 - ITR4 Filing IndividualProprietor Business Partnership Firm (1.04 GB)

241 - TDSComprehensive Case Study 26Q (1.25 GB)

242 - 1whatistaxwhentaxesintroducedinindia 1080p (9.14 MB)

243 - 2directtaxesvsindirecttaxes 1080p (6.8 MB)

244 - 3incometaxbasicswaysofcollectingincometax 1080p (76.43 MB)

245 - 4whentofileitrsenglish 1080p (29.21 MB)

246 - 5whatisitrapplicabilityofitrs 1080p (146.1 MB)

247 - 6whatistaxauditwhentotaxauditobjectivesformsduedatespenalties (78.29 MB)

248 - 7incometaxcomputationformatalltypeoftaxpayers 1080p (556.23 MB)

249 - 8incometaxcomputationindividualenglish 1080p (82.61 MB)

250 - 9howtoregisterpaninincometaxportal 1080p (38.83 MB)

251 - 10whatisform26asandhowtoviewit 1080p (68.01 MB)

252 - 11itr1filingenglish 1080p (453.02 MB)

253 - 12itr4filingbusinessandprofession 1080p (170.86 MB)

254 - 13filingitr4forpartnershipfirm 1080p (195.13 MB)

255 - 14whatistdstdsbasics 1080p (72.93 MB)

256 - 15tdsprocessoverview 1080p (252.27 MB)

257 - 16whocandeducttds 1080p (23.22 MB)

258 - 17howtoapplyfortannew1new 1080p (150.41 MB)

259 - 18tdspayment 1080p (157.93 MB)

260 - 19tdsreturns 1080p (44.06 MB)

261 - 20recordingtdstransactionsintallyprime 1080p (213.08 MB)

262 - 21tdsonsalary 1080p (34.39 MB)

263 - 22tdspayments 1080p (164.24 MB)

264 - 23maintainingtdschallaninformation 1080p (95.61 MB)

265 - 24downloadandinstalltdsrpujavawinrar 1080p (90.05 MB)

266 - 25downloadcsifilechallanstatusinquiryfilestoimportintdsreturnspr (67.64 MB)

267 - 26tdsreturnpreparationform26q 1080p (231.54 MB)

268 - 27tdsreturnpreparationform24qnew 1080p (390.62 MB)

269 - 28panandtanregistration 1080p (40.42 MB)

270 - 29submittingtdsfilesnew 1080p (87.7 MB)

271 - 30howtoviewsubmittedtdsandcollecttokenrrrnumber 1080p (6.91 MB)

272 - 31whatistdscertificateandtypes 1080p (11.71 MB)

273 - 32registrationtanontdstracesportal 1080p (46.03 MB)

274 - 33tdsreturnstatus 1080p (18.11 MB)

275 - 34howtodownloadtdscertificatesform16partaorb 1080p (103.75 MB)

276 - 35downloadtdscertificatescompleteprocess 1080p (407.36 MB)

277 - 1 MS Excel Launching Basics of Excel Main Dashboard Interface (144.45 MB)

278 - 2 MS Excel Cells Rows Columns and Sheets Basics (120.44 MB)

279 - 3 MS EXCEL Home Tab Basics Editing and Formatting (486.31 MB)

280 - 4 Copy Paste Functions All Types (159.39 MB)

281 - 5 Home Tab Customisation of Tabs (96.71 MB)

282 - 6 MS Excel Speak Cells (68.19 MB)

283 - 7 Text to Columns MS Excel Split Tool (81.86 MB)

284 - 8 Characteristics of a Cell and Cell References (83.54 MB)

285 - 9 Comments in MS Excel Insert Edit Paste and Customise Comment Background (139.42 MB)

286 - 10 Fill Series Basics Fill Data only Fill Format Fill Weekdays and more (22.37 MB)

287 - 11 Fill SeriesAdvanced Fill Interval Custom Lists and Fill side (99.78 MB)

288 - 12 Fill Series Flash Fill (114.34 MB)

289 - 13 MS ExcelHow to Hide and Unhide Rows Columns Sheets (131.22 MB)

290 - 14 Freeze PanesTop Row Columns Multiple Rows Columns (132.67 MB)

291 - 15 MS ExcelFiltersLearn How to Use Filter to analysis a Big Data (163.16 MB)

292 - 16 MS Excel Split Sheet Window (69.75 MB)

293 - 17 MS ExcelHow to Insert Delete Cells Rows and Columns (74.8 MB)

294 - 18 MS ExcelWorking with Sheets (142.33 MB)

295 - 19 MS ExcelView Sheets Side by Side from One Excel File (62.05 MB)

296 - 20 MS Excel Workbook Protection Learn how to setup a Password to open Excel F (65.02 MB)

297 - 21 MS excel sheet cells protection (45.45 MB)

298 - 22 MS Excel ConcatenateJoin Multiple Text Strings into ONE (5.4 MB)

299 - 23 MS ExcelTrimFunctions Remove unnecessary Elements from strings (8.07 MB)

300 - 24 MS Excel Print Formulas Left Right Middle (25.1 MB)

301 - 25 MS Excel Date Related Formulas (24.67 MB)

302 - 26 MS ExcelPrint Page Setup Margins Size Excel to PDF (124.18 MB)

303 - 27 MS ExcelPage Header Footer Add Page Numbers Logo Report Name Date Time (59.19 MB)

304 - 28 MS Excel Conditional Formatting (155.27 MB)

305 - 29 MS excel import data from web (108.62 MB)

306 - 30 MS Excelimport data from text document with auto refresh (47.6 MB)

307 - 31 MS Excelimporttext word ppt jpeg video pdf more objects (120.86 MB)

308 - 32 MS Excelformat multiple sheets at a time (70.23 MB)

309 - 33 MS Excel HyperLinks Links to SheetFileWebPages and more (199.41 MB)

310 - 34 MS Excel Logical Functions Test Functions (25.73 MB)

311 - 35 MS Excel IF formulas IF IFand IFor nestedIF IFerror (364.33 MB)

312 - 36 MS Excel Student Marksheet Calculation using Sum Nested IF Rank Status (319.81 MB)

313 - 37 V Lookup Exact Match and Approximate Match (242.65 MB)

314 - 38 MS Excel H Lookup (81.84 MB)

315 - 39 MS Excel X Lookup Download and Add to your Excel (86.71 MB)

316 - 40 X Look up Basics (4.47 MB)

317 - 41 MS Excel X lookup Formula (181.18 MB)

318 - 42 MS Excel EMI and Loan Statement Preparation PMT PPMT IPMT (377.31 MB)

319 - 43 MS Excel DropDownList Creation Dependent List Independent List Data (242.28 MB)

320 - 44 Data Validation DateListWhole Number Text LengthNested IfIfs and mor (453.83 MB)

321 - 45 Macro Part1 Designing a Form (100.29 MB)

322 - 46 Macro Part2 Recording and Running a Macro (271.33 MB)

323 - 47VBAMacroIntroduction (5.54 MB)

324 - 48 3D SUM Calculate Multiple Sheet and analyse (89.33 MB)

325 - 49 CONSOLIDATE 3D SUM EXTENSION (63.33 MB)

326 - 50 Age Calculator Exclusive and Inclusive (24.24 MB)

327 - 51 BAR CODE GENERATOR in MS Excel (62.58 MB)

328 - 52 Charts Pie Charts (125.58 MB)

329 - 53 Charts Bar Charts and Column Charts (133.63 MB)

330 - 54 Auditing Tools Trace PrecedentsDependentShow Formula and more (74.7 MB)

331 - 55 Statistical Formulas SumSumifsumifsavgavgifavgifscountcountifcount (181.1 MB)

332 - 56 INDEX (42.4 MB)

333 - 57 MATCH (10.79 MB)

334 - 58 PIVOT TABLE BASICS (5.63 MB)

335 - 59 CreateaPivot ChartfromTablePivotTable (5.13 MB)

336 - 60 PivotTableUseslicerstofilterdata (10.47 MB)

337 - 61 Sales Register Maintenance (292.63 MB)

338 - 62 commission calculation (79.28 MB)

339 - 63 Attendance Sheet Preparation (123.99 MB)

340 - 64 Salary Calculation (78.45 MB)

341 - 65 CreatingProfessionalInvoiceinExcel (101.89 MB)

342 - 66 2D Geographi Charts Map Chart Basics (34.25 MB)

343 - 67 2D MAPS ADVANCED (55.58 MB)

344 - 68 3D Maps Make scenes Export Video Time Lapse (322.27 MB)

345 - 69 3D MAPS Statewise Product Sale (44.58 MB)

347 - Shortcut Keys of Excel (12.43 MB)

348 - Learn How to Download Certificate of Completion from Udemy (28.36 MB)

349 - Know more about Student Dashboard Tally Education Job Portal Benefits (7.22 MB)

8 - S22 Tally Certifications awareness (126.29 MB)

10 - S32 TallyPrime Licnese Modules and Pricing (36.54 MB)

11 - S33 Tally Rental License Request (15.24 MB)

12 - S34 Download and Installation Update TallyPrime (118.08 MB)

13 - S35 TallyPrimeLaunching Working in Education Mode Licensing Operations (27.7 MB)

14 - S36 TallyPrimeCompany Creation Alteration and Deletion (113.24 MB)

15 - S37 TallyPrimePredefined Vouchers Introduction (19.5 MB)

16 - S38 Recording Purchases Sales (168.99 MB)

17 - S39 Recording Contra Receipt and Payment Vouchers (387.3 MB)

18 - S310 Recording Journals in TallyPrime (40.33 MB)

19 - S311 How to update Opening Balances Opening Stock in TallyPrime (75.06 MB)

20 - S312 TallyPrimeGroup CompanyCreation Alteration and Deletion (75.27 MB)

21 - S313 TallyPrimeData Entry Steps Ledgers Items and Vouchers (70.97 MB)

9 - S31 Overview on Tally History Advantages Releases (158.91 MB)

22 - S41 What is GSTa short Introduction to GST (77.98 MB)

23 - S42 GST Classifications and Place of Supply (11.63 MB)

24 - S43 Recording GST Purchases Sales Traditional Method (672.5 MB)

25 - S44Recording GST with Auto Billing Exclusive GST Ledgers for Input n Output (50.01 MB)

26 - S45 Billing Configuration Company Logo (69.12 MB)

27 - S46 Billing Configuration Additional Description for Stock items Ledgers (30.29 MB)

28 - S47 Billing Configuration Enable Rate Inclusive of Taxes column (9.35 MB)

29 - S48 Billing Configuration Update Sales Voucher Numbering (27.35 MB)

30 - S49 Printing PreferencesCust Seal and Signature Jurisdiction Bank Details I (95.54 MB)

31 - S410 Optimize Printing Paper Size (42.23 MB)

32 - S411 Recording GST Services I Sales and Purchases of Services in TallyPrime (66.46 MB)

33 - S412 Recording GST Expenses Claimable and Nonclaimable (177.91 MB)

34 - S413 Recording GST Assets claimable and nonclaimable (159.69 MB)

35 - S51 Understanding GST Returns Types (153.52 MB)

36 - S52 GST Tax Computation and Adjustments (38.82 MB)

37 - S53 Learn GSTR1 Tables (270.84 MB)

38 - S54 GSTR1 Filing using TallyPrime (246.91 MB)

39 - S55 Filing NilGSTR1 I when there is no Sales (32.81 MB)

40 - S56 GSTR1 Amendments I Modify Previous Months Invoices (65.35 MB)

41 - S57 Purchases Reconciliation I GSTR2A Reconciliation I 2 Methods (153.06 MB)

42 - S58 GSTR3B Tax Payment I Filing GSTR3B I Tax Summary Adjustments (215.41 MB)

43 - S59 EWay BillRegistration (72.93 MB)

44 - S510 EWAYBILL Generation Cancellation Update and more (205.15 MB)

45 - S511 E Invoice Introduction (17.96 MB)

46 - S512 EInvoice GSTIN Registration of E Invoice Portal (21.96 MB)

47 - S513 EInvoice Enablement for GSTIN on E Invoice Portal (53.56 MB)

48 - S514 EInvoice API User Creation for Your Accounting Software (78.04 MB)

49 - S515 Generate EInvoice using Tally Generate and EInvoice Print within Tall (163.6 MB)

50 - S516 E Invoice Cancellation in Tally as well as Einvoice Portal (84.84 MB)

51 - S517 EInvoice Generation Tally to JSON JSON Manual Upload on E Invoice Por (86.14 MB)

52 - S518 EInvoice Generation Using Official Excel kit Excel to JSON JSON upload (58.6 MB)

53 - S519 GST Composition scheme introduction Slabs Eligibility (70.27 MB)

54 - S520 GST CMP08 Filing Composition GST Return Filing (151.35 MB)

55 - S61 Inventory Management Introduction Importance Advantages (20.64 MB)

56 - S62 Creation of Unit of Measurement (12.47 MB)

57 - S63 Stock Group Creation and Alteration (22.54 MB)

58 - S64 Stock Category Creation and Alteration (7.71 MB)

59 - S65 Stock Items Creation and Alteration (25.76 MB)

60 - S66 Activation of Batches for Stock Item (23.5 MB)

61 - S67 allocation of batch details in purchase invoice (205.82 MB)

62 - S68 selling of stock items from batch and identifying of expired batch in sales (237.67 MB)

63 - S69 Returning of Expired Batch Stock Item (64 MB)

64 - S610 Activating Price Levels (16.78 MB)

65 - S611 defining price levels creating price list usage of price list in sale vo (221.24 MB)

66 - S612 Revise Price List (12.94 MB)

67 - S613 Different Types of Inventory Valuations (18.74 MB)

68 - S614 Activation of Purchase Order and Sales Order (15.65 MB)

69 - S615 Activation of Delivery Receipt Notes (35.21 MB)

70 - S616 Activation of Debit Credit Note (8.65 MB)

71 - S617 purchases management purchase order receipt note purchase purchase re (273.76 MB)

72 - S618 Sales Management Sales Order Delivery Note Sales Sales Return (77.48 MB)

73 - S619 Creation of Godown (8.53 MB)

74 - S620 How to Create and Manage Multiple Godowns in TallyPrime (36.78 MB)

75 - S71 Billwise Accounts An Introduction (55.84 MB)

76 - S72 Billwise Accounts Purchases (67.59 MB)

77 - S73 Billwise Accounts Sales (117.41 MB)

78 - S74 Billwise Accounts Tracking Overdue Supplies (86.6 MB)

79 - S75 Billwise Accounts Advances Management (55.73 MB)

80 - S76 How to view and analyse bills outstanding reports in tallyprime (71.72 MB)

81 - S81 Cheque book configuration in tallyprime (110.46 MB)

82 - S82 Cheque Printing in TallyPrime (95.07 MB)

83 - S83 Enabling All Banking Transaction Types (22.54 MB)

84 - S84 An introduction to post dated cheques management (48.2 MB)

85 - S85 Post dated cheques management in tallyprime (304.12 MB)

86 - S86 Applying for TallyPrime License (32.73 MB)

87 - S87 Introduction to bank reconciliation process in tallyprime (30.47 MB)

88 - S88 Bank reconciliation in tallyprime (356.35 MB)

89 - S89 How To Do AutoBank Reconciliation (101.82 MB)

90 - S91 Calculator Usage in TallyPrime (33.51 MB)

91 - S92 Alternative unit of Measurement (34.29 MB)

92 - S93 Part Numbers in TallyPrime (21.5 MB)

93 - S94 Standard Rate Setups in Tallyprime (30.55 MB)

94 - S95 Export Reports from Tally I Excel PDF JPEG (95.73 MB)

95 - S96 Group Company Creation Alteration (99.38 MB)

[center]

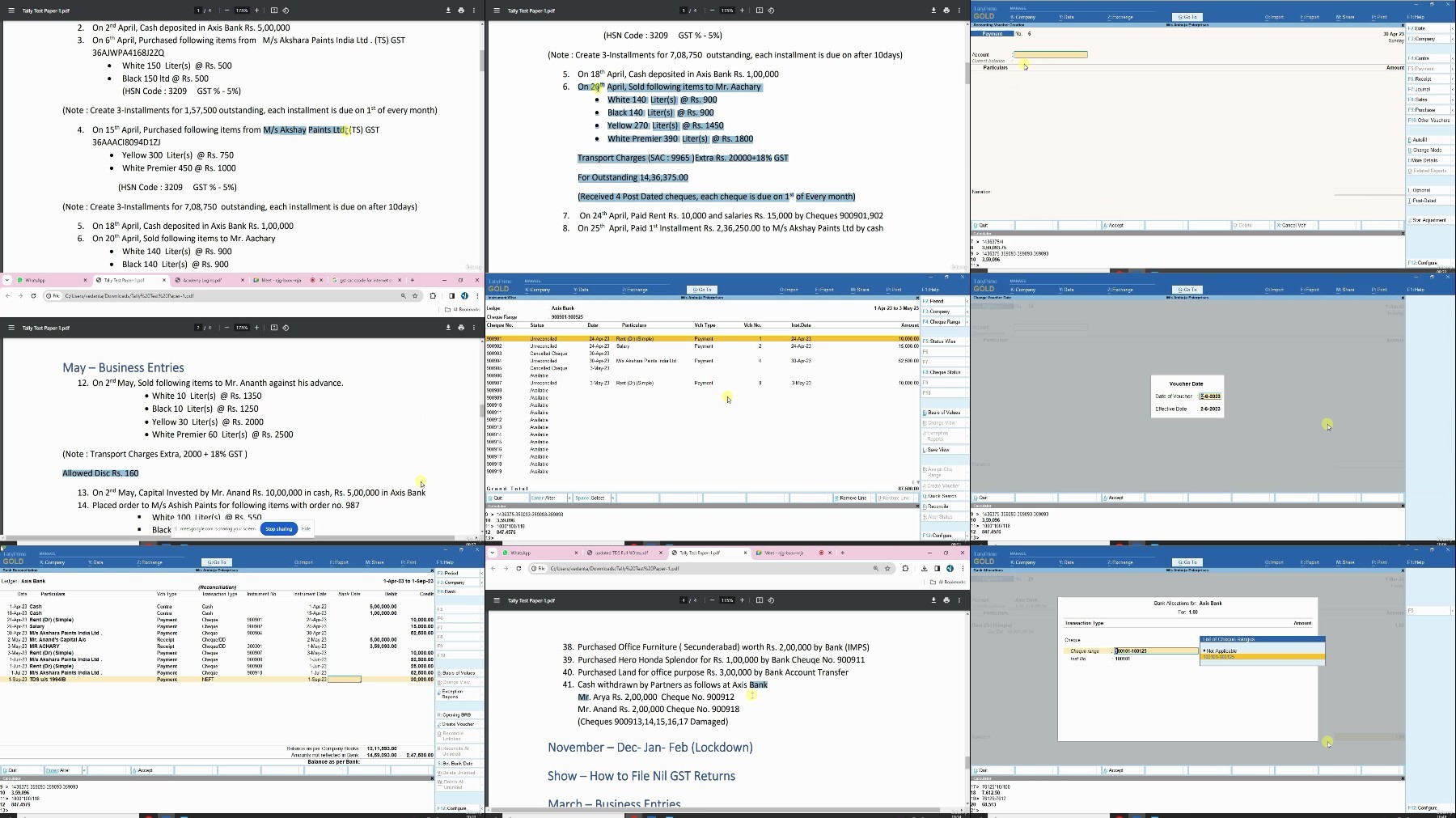

Screenshot

[/center]

Warning! You are not allowed to view this text.

Warning! You are not allowed to view this text.

Warning! You are not allowed to view this text.

Join to our telegram Group

Information

Users of Guests are not allowed to comment this publication.

Users of Guests are not allowed to comment this publication.

Choose Site Language

Recommended news

Commented

![eM Client Pro 9.2.1735 Multilingual [Updated]](https://pikky.net/medium/wXgc.png)

![[PORTABLE] Master PDF Editor 5.9.10 Multilingual (x64)](https://pikky.net/medium/TYgc.png)

![Movavi Video Editor 24.0.2.0 Multilingual [ Updated]](https://pikky.net/medium/qhrc.png)