Most Commented

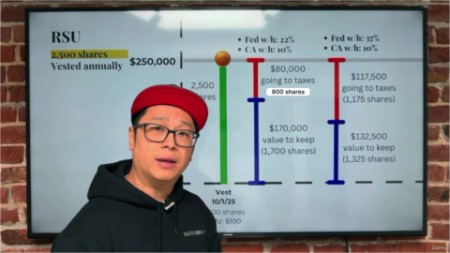

Using Visuals To Simplify Restricted Stock Units

Description material

Using Visuals To Simplify Restricted Stock Units

Last updated 10/2024

MP4 | Video: h264, 1920x1080 | Audio: AAC, 44.1 KHz

Language: English | Size: 1.04 GB | Duration: 0h 44m

Learn how to talk to clients

What you'll learn

Understanding Restricted Stock Units (RSU), throughout all various stages that a client may experience

Client-ready visuals that will guide you through RSU transactions, ensuring you're equipped to handle discussions from grant stage to selling stage.

Know how to present the visuals to clients and explain it clearly

Be able to answer client questions about their RSUs like a tax pro

Requirements

Basic tax knowledge

have some tax experience

Description

An online e-learning course where we use visuals to help explain Restricted Stock Units. We go through the various scenarios taxpayer may face with their RSUs and will be able to know the tax implication with each scenario.The goal for taking this e-learning course is to get you to confidently speak to client about complex tax topics. Use our methods to impress clients with your knowledge and showcase your value by providing real tax strategies your clients can use.Our course provides:Understanding Restricted Stock Units (RSU), throughout all various stages that a client may experienceClient-ready visuals that will guide you through RSU transactions, ensuring you're equipped to handle discussions from grant stage to selling stage.Exercises using the "Blurt Method," an effective technique that will get you to confidently speak to clients about complex tax topics.Mock practices where we simulate a chat between you and the client. Your goal is to get through the conversation answering all the client's questions correctly. Answer anything wrong, you can end up losing the client!Start mastering the art of clear client communications today!Here's an outline of what to expect in this e-learning course:Lesson #1 - RSUs: Vesting - public companyVideo #1 (10 minutes)Video #2 (11 minutes)Download and review the visual Mock client meeting w/ 10 questions (18 minutes)Lesson #2 - RSUs: Vesting - pre-IPO companyVideo (13 minutes)Download and review the visual Lesson #3 - RSUs: SellingVideo (9.5 minutes)Download and review the visual Final LevelFinal exam w/ 5 questions (9 minutes)

Overview

Section 1: Introduction

Lecture 1 Let's get started!

Section 2: Lesson #1 - RSUs: Vesting - public company

Lecture 2 Video #1 - RSUs: Vesting - public company

Lecture 3 Video #1.1 - RSUs: Vesting - public company

Lecture 4 Mock Client Meeting - RSU: Vesting public company

Section 3: Lesson #2 - RSUs: Vesting - private company

Lecture 5 Video #2 - RSU: Vesting pre-IPO company

Section 4: Lesson #3 - RSUs: Selling

Lecture 6 Video #3- RSUs: Selling

Section 5: Final Test

Tax professionals who want a clearer understanding of Restricted Stock Units.

Download

Fikper

RapidGator

NitroFlare

Fikper

RapidGator

NitroFlare

Join to our telegram Group

Information

Users of Guests are not allowed to comment this publication.

Users of Guests are not allowed to comment this publication.

Choose Site Language

Recommended news

Commented

![eM Client Pro 9.2.1735 Multilingual [Updated]](https://pikky.net/medium/wXgc.png)

![Movavi Video Editor 24.0.2.0 Multilingual [ Updated]](https://pikky.net/medium/qhrc.png)